single life annuity with 10 years guaranteed

But the monthly payout will cease when she dies so if she lives only one year no. 100 joint and survivor.

Do You Really Need 8 Million Saved Up For Retirement Marketwatch Lifetime Income Do You Really Retirement

55 60 65 69 70 75 80.

. If you pass away during the guaranteed period the rest of the payments will go to your beneficiary. If the annuitant dies before the guaranteed period has expired the payments can be passed to a beneficiary. There is no cost or obligation and your privacy is guaranteed.

Immediate annuity rates depend on your upfront payment amount contract terms age and gender. If the annuitant outlives the ten years of guaranteed payments they. Means a Single Life Annuity except that if the individual receiving the annuity should die before annuity payments have been made for ten years payments in the same amount shall continue for the remainder of the ten-year period to the Members Beneficiary.

If Sara chooses the single-life option she will receive 1741 per month for as long as she lives. No rolling surrender charges 3 yrs and done No rolling surrender charges 5 yrs and done No rolling surrender charges 7 yrs and done NEW Single Premium Multi-Year Guaranteed Rate Annuity that in addition to the strong guaranteed interest rates above also provides. If no valid Beneficiary designation exists at the time any payment is due.

After the 10 years initial guarantee period you will have the option to either renew for another 10 year period at the new declared interest rate withdraw your annuity account value convert your annuity to monthly income payments or transfer to a new annuity using a tax-free 1035 exchange. A 10-year term certain annuity payout means that payments are guaranteed to be made for at least 10 years. If you choose a guarantee period and die before the end of the period your.

CEO The Annuity Expert. Say you had a lifetime annuity with a 10-year period certain. With a single life pension you can choose a lifetime monthly pension payment with.

With a single life pension you can choose a lifetime monthly pension payment with. Life annuity means an annuity payable under a policy issued to an SRS member for a term ending with or at a time ascertainable only by reference to the end of his life. Single life with a 10-year certain term.

Ad 2022s Top Life Insurance Providers. If the annuitant outlives the 10 years of guaranteed payments then. Majestic Life Church Service.

Restaurants In Matthews Nc That Deliver. 10 annual penalty-free withdrawals. Single life male 10 year guarantee Financial Institution Age in Years.

Full Value at Death. For example if you purchase a single-life annuity with a 20-year period certain and pass away 10 years later your beneficiary will collect income benefits for another 10 years. Related to OPTION B - Life Annuity with 10 Years Guaranteed.

If the annuitant outlives the ten years of guaranteed payments they will continue to receive income payments. Life annuity means an annuity payable under a policy issued to an SRS member for a term ending with or at a time ascertainable only by reference to the end of his life. Define Single Life Annuity With Ten Years Certain.

If you pass away during the guaranteed period the rest of the payments will go to your beneficiary. This income would be paid to you but can pass to a named beneficiary when you die. A 10 Year Certain And Life Annuity is a type of annuity that will provide payments to you for the rest of an annuitants lifetime with a minimum of 10 years even if you die.

A typical period for a period certain annuity is 10 or 20 years. The insurance company promises to pay out for the rest of your life but no less than 10 years. 10 rows Single Life Annuity.

Single Life Annuity means an annuity providing equal monthly payments for the lifetime of the Member with no survivor benefits. But they stop immediately upon your death. Life-only payments continue as long as you live.

A premature death reduces the value of a single life annuity because payments end with the annuity holders death. A 10 Year Certain And Life Annuity is a type of annuity that will provide payments to you for the rest of an annuitants lifetime with a minimum of 10 years even if you die. Todays Best Annuity Rates.

For example if you choose a single life pension guaranteed for 10 years which is 120 payments and die before 120 payments have been made to you whats left of your pension will be paid to. What is a Life Annuity with Period Certain Annuity. A ten-year fixed annuity pays a guaranteed interest rate for 10 years.

Related to 10 Year Certain Single Life Annuity. A guarantee period of 5 10 or 15 years. If you pass away during the guaranteed period the rest of the payments will go to your beneficiary.

A life annuity with period certain is a hybrid option that provides lifetime payments with guaranteed income for a specified number of years. Term-certain payments are paid for a specified number of years and can continue after your death. A guarantee period of 5 10 or 15 years If you die before the end of the period your beneficiaryies will receive your monthly pension for the remainder of the guarantee period only.

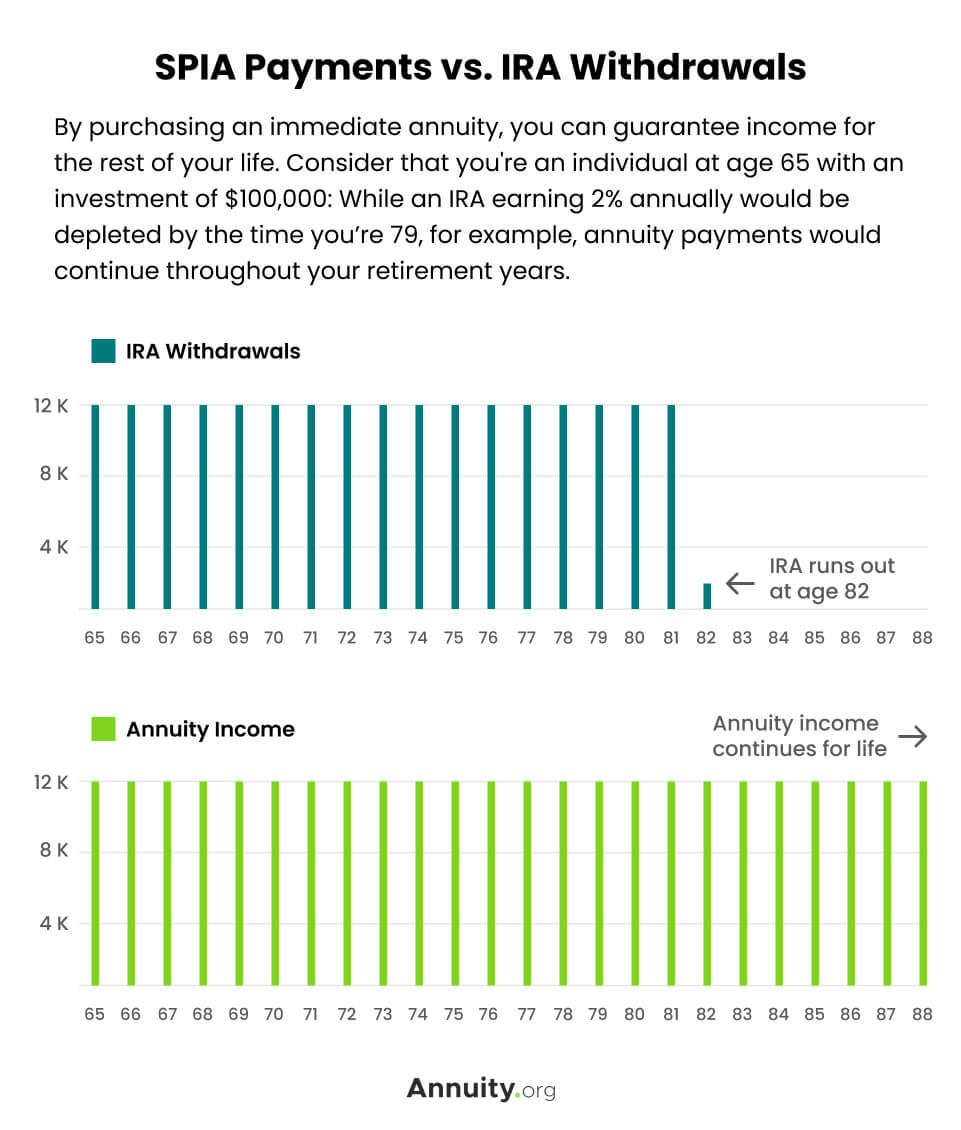

An immediate annuity is simple and consumer-friendly. You can choose a single life pension option if you are single or your spouse has given up their rights to your pension. 50 joint and survivor.

Registered male annuity rates with a 10 year guarantee period. Single Life Annuity means an annuity providing equal monthly payments for the lifetime of the Member with no survivor benefits. The period certain annuity also helps moderate the risk of an annuity buyer dying prematurely.

The income you receive from the annuity is guaranteed for the time period that you specify. Even if you live for 40 or 50 years after you start receiving payments the guaranteed payments will continue. A 10 Year Certain And Life Annuity is a type of annuity that will provide payments to you for the rest of an annuitants lifetime with a minimum of 10 years even if you die.

A life annuity with period certain annuity is a contract that guarantees payments for an annuitants entire life along with a guaranteed period of time typically 5 to 20 years. Immediate annuities guarantee an income stream within a month of purchase without an accumulation period.

Jeevan Shanti How To Plan Shanti Annuity

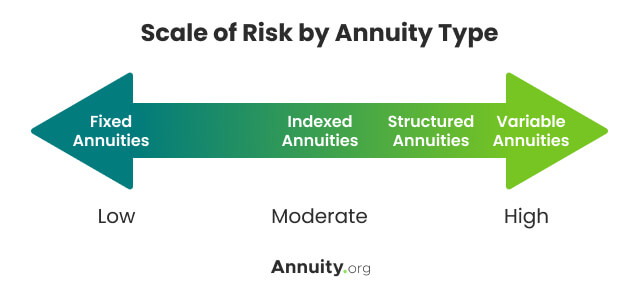

Types Of Annuities Understanding The Different Categories

Does An Annuity Plan Work For You Businesstoday Issue Date Mar 08 2020

The Important Difference Between Annuities And Life Insurance Aaa Life Insurance Marketing Life Insurance Annuity

Annuity Payout Options Immediate Vs Deferred Annuities

Single Premium Immediate Annuity Spia Rates Pros Cons

Silac Insurance Company Ratings Review 2021 Insurance Company Casualty Insurance Annuity

Example Myga Fixed Annuity Statement And Purchase Experience My Money Blog Annuity Life Insurance Companies Lifetime Income

Life Annuity With Period Certain The Annuity Expert

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

Calculating Present And Future Value Of Annuities

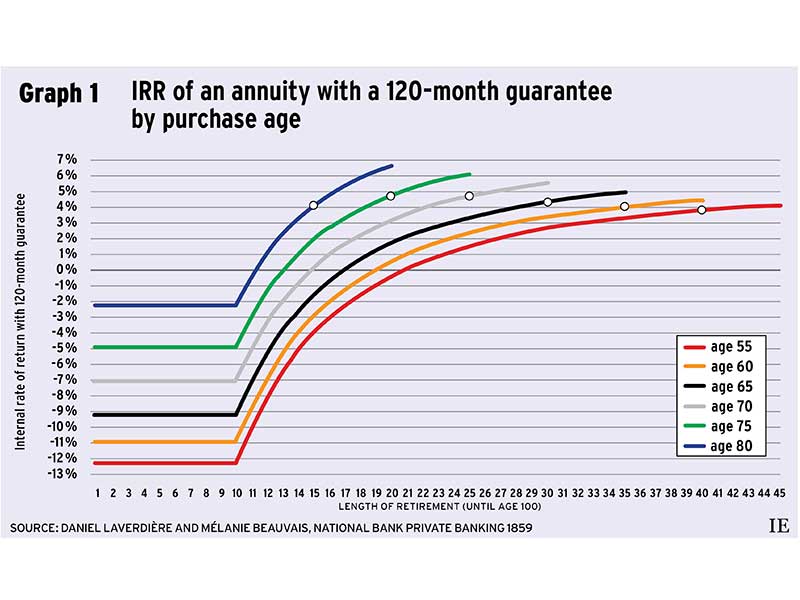

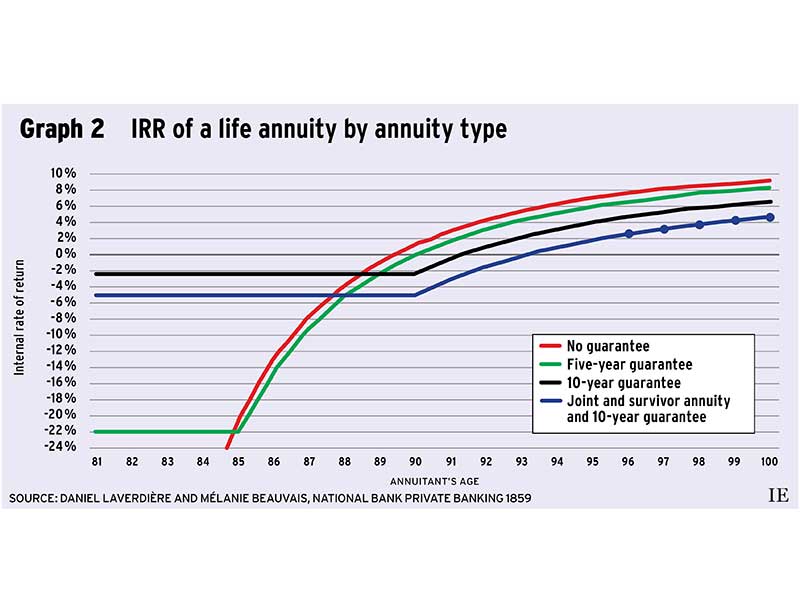

The Case For Life Annuities Investment Executive

Create Income That Can Last A Lifetime Fidelity Investments Lifetime Income Income Annuity

Insurance Forums 1 6 Billion What Life Insurers Pay Out In Claims Every Day Life Insurance For Seniors Life Insurance Quotes Affordable Life Insurance

Annuity Payout Options Immediate Vs Deferred Annuities

Period Certain Annuity What It Is Benefits And Drawbacks

Lic Pension Plans Pension Plan Life Insurance Sales How To Plan

Joint And Survivor Annuity The Benefits And Disadvantages

The Case For Life Annuities Investment Executive

Great Reasons To Transfer Money From A Rrif To An Annuity Advisor S Edge